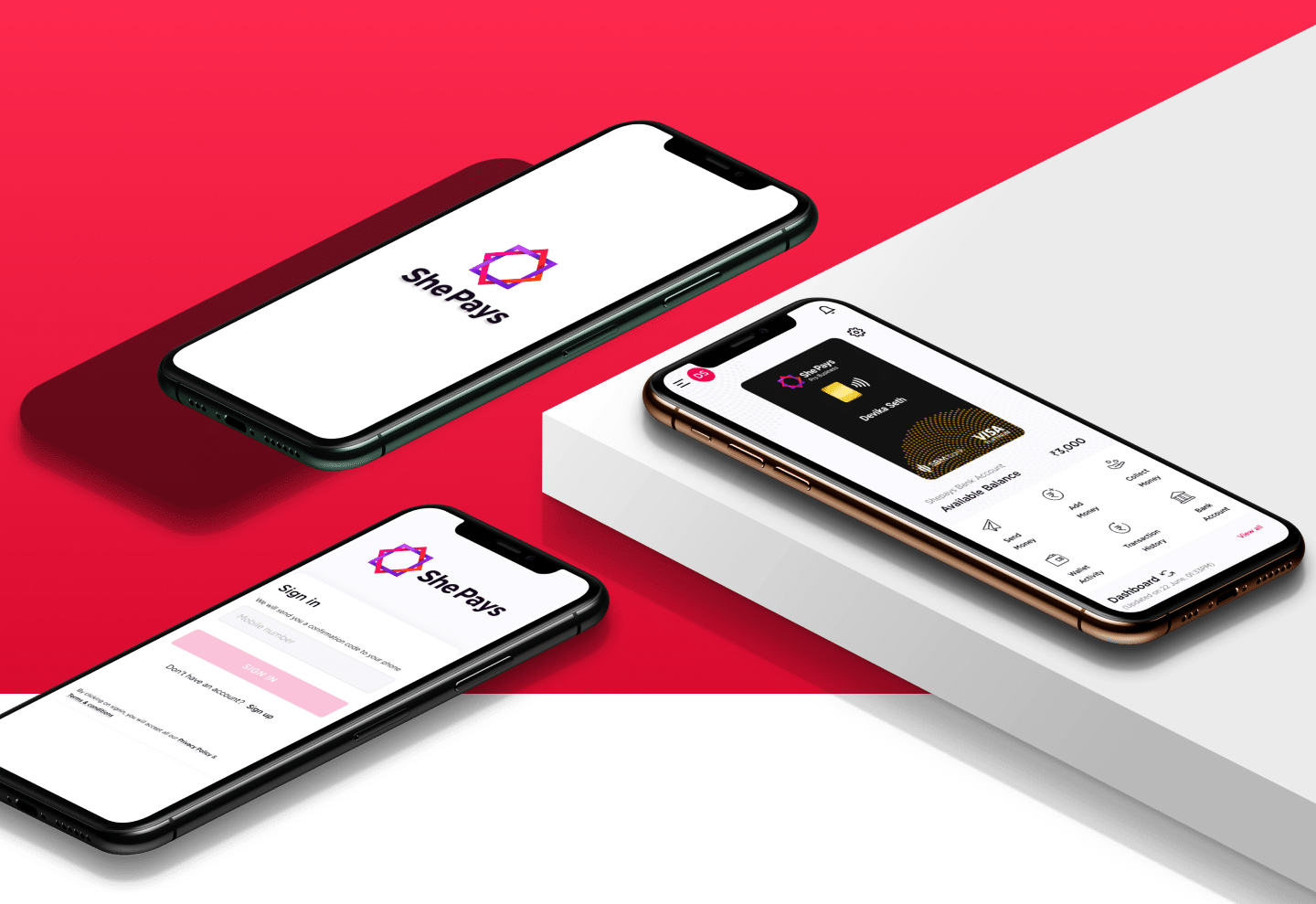

Our client needed a next-gen banking solution to empower women by ensuring handy banking services, money transfers, insurance, and online purchase. Thus, the company partnered with OrangeMantra to prepare a banking mobile app from scratch. App was integrated with splendid UI and advanced digital finance & banking features that can stand out among users. Moreover, it was essential for the client to empower women by educating digital finance and expenditure management.

BFSI

Digital Banking & Finance, Mobile Apps

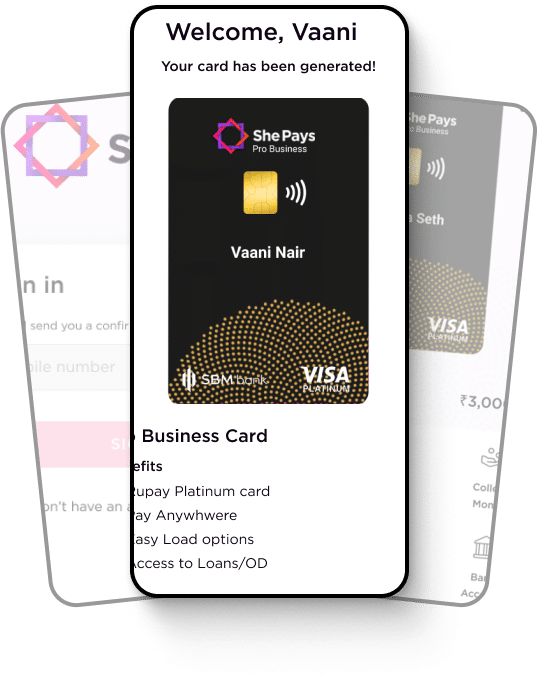

Our team delivered a next-gen banking mobile application packed with several enticing features. The major ones were, a mobile wallet, P2P money transactions, UPI payments, stock investment, loan application management, credit & debit card activation, KYC, and much more. While we also integrated an in-app online shopping solution that helps users to find the best deals on cosmetics, clothing, and accessories. Meanwhile, the application also enabled an insurance solution for vehicles, gadgets, and healthcare making a one-stop shop for women to thrive. On the technology front, this native app was empowered with several powerful APIs such as Cashfree, and SmallCase, which ensure the utmost security in money transfers.

We started with in-depth market surveys, interviews, and client requirement gathering session to understand the unique financial needs and preferences of women.

Next step was to create interactive prototypes to perform user testing, inclusion of feedback to redefine the user interface and experience.

Our developer followed an iterative development process with regular feedback session, allowing integration of user suggestions and improvements.

We prioritized a personalized marketing strategy to create awareness and engage women users to the mobile application, followed by a phased deployment.

The major roadblock in the way was keeping the solution unique while beating the existing banking and wallet applications. Meanwhile, the notion of empowering women requires in-depth target audience research while learning about the major challenges women face in adopting banking apps and their interests. Also, infusing complex financial offerings in one application required strong technology amalgamation, efficiency & expertise. Moreover, it was complex to integrate high-grade security in data safety and transactions while keeping the app simple & straight.

Analysis and integration of diverse financial needs of women within the app including budgeting, investing, and savings is a challenging process.

Bringing advance security and building trust in financial services is a challenge, and ensuring the app’s security can prevent any online threat.

Overall, the project was a great hit after initial MVP launch and grabbed significant attention of users, investors, and tech enthusiasts. The application is available on both Google play store & Apple Store and receiving continuous downloads. It helped our client enter in digital banking & fintech space while making finance & banking operations handy to household women. The app not only met the ShePays objectives as well as contributed to the financial empowerment, education, and community building.

The app helped in rapid growth of financial literacy among women users, empowering them to make smart use of their hard earned money with informed financial decisions.

The app received positive response from users offering better financial well-being, with enhanced budgeting skills, increased savings, and diverse investment options.

The app’s community forum became a perfect space for women to connect, do discussions, share advice, and support each other in planning their financial journeys.