Our client is a bank that offers simple financial management services. They provide loans to individuals and have flexible repayment options that fit each person’s financial situation. They wanted to improve how they handled different financial and risk management goals. First, they needed to find a partner with experience to help create a solution. OrangeMantra was chosen because of our expertise in financial management. After choosing to work with OrangeMantra, our client also wants to improve their existing loan management software to better organize customer and financial data, automate loan processes, and manage loan repayments.

BFSI

Dashboards & Analytics, Mobile Apps

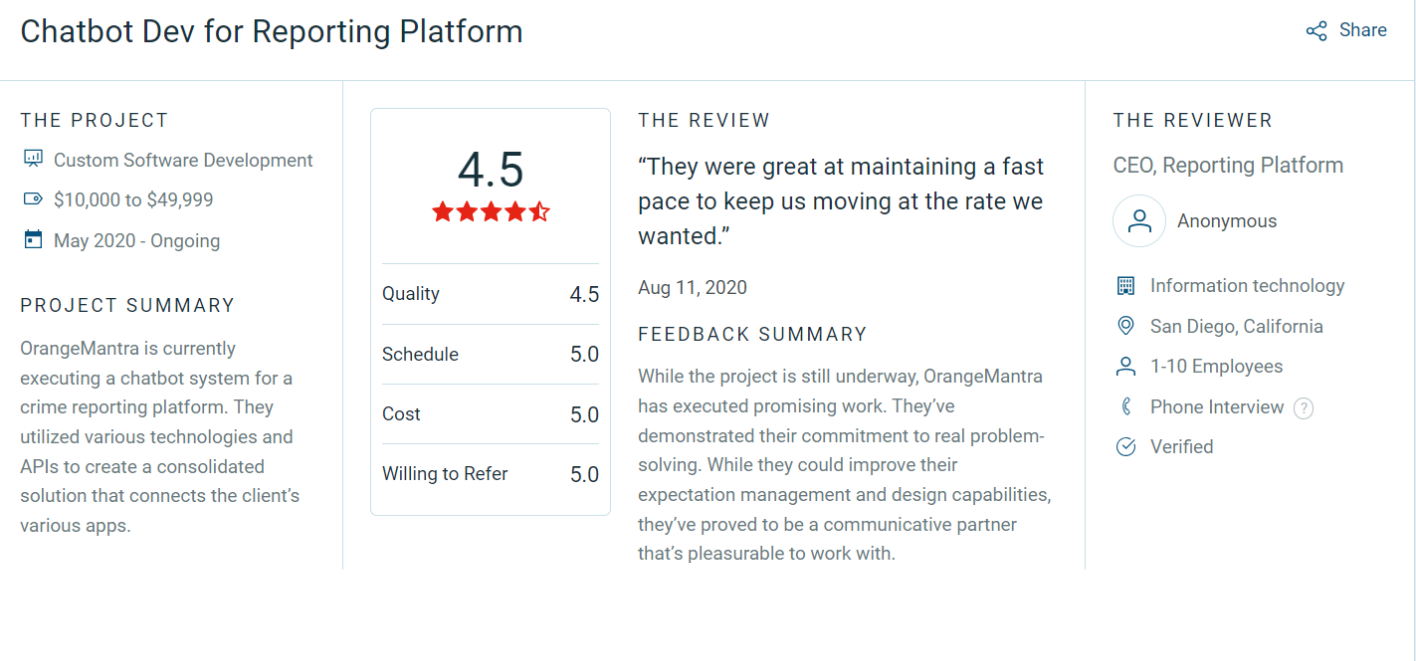

With OrangeMantra extensive experience in creating software for financial companies, the client approached us to develop a custom loan management dashboard. After analyzing the client’s needs, our business analyst gathered detailed requirements for the risk management key performance indicators (KPIs). Based on these requirements, we concentrated on the best architecture, features, and technology stack for the software. This helped us determine the resources needed to finish the project. We assembled a team of senior and lead-level experts in financial software development to manage the project budget and guarantee the timely completion of the loan management solution.

Our team figured out what the financial management dashboard should do and what we wanted it to achieve. We thought about who would use it, what important things it should have, and what results we wanted from it. This made the rest of the work go smoother.

We made the look of the dashboard, choosing colors, features, and pictures. We wrote the code for the front part of the dashboard to make it work and be easy to use.

We did a lot of testing to find and fix mistakes, make sure it works on different web browsers, and check that all the features do what they’re supposed to. We also tested the dashboard with lots of information and different screen sizes.

After looking at how well it handles money and risk, we put it on a server where it can be used. We keep an eye on how it’s doing after it’s out, fixing any problems quickly. We also regularly update the software to keep it safe.

A large Indonesian bank wanted to improve customer engagement rate, streamline loan origination and internal communication to support automation. The company sought to have a secure dashboard application, which would enable employees to manage bank account holder finances. Our client decided to develop its dashboard solution and replace its legacy approach. Due to our long standing relationship with the bank, it partnered with OrangeMantra to deliver a new platform and solution. The client needed a user-friendly and advanced dashboard application that would help their employees better manage loans through simple and intuitive interactions.

Dashboards help companies gather important information about what customers like, what they do, and who they are. If companies don’t have this information, they can’t fully understand their customers or adjust their services to better meet their needs.

If a company doesn’t use a dashboard, it can be hard to keep track of how well the business is doing. Companies might find it difficult to check their financial status, assess risks, see how people are interacting with their products, and determine if they are making money from their investments.

OrangeMantra, a skilled developer of Dashboard tools for banks, assisted the client in creating new loan management software to replace outdated systems. The bank has updated its services by introducing advanced risk management tools with comprehensive features. Important additions included tracking loan balance increases, opportunities for additional sales, installment loan payments, and more. This allows the bank to attract more customers, build loyalty, and become a leader in the financial services industry.

Dashboards provide updates on important numbers as they happen or very soon after. Danamon could watch their progress right away, which helped them make decisions quickly and respond fast.

Customers can bring together information from different places into one easy-to-see spot. This means they don’t have to look in many different places or read many reports, which saves time and makes things work better.

Having important information in an easy-to-understand manner helps leaders make smart decisions based on facts. It is quite helpful for planning and setting goals.