The blog explores how IoT technology is transforming the banking and finance sector by enabling real-time data collection, personalized customer experiences, improved security, and operational efficiency, helping financial institutions stay competitive and innovate.

- Enhanced Customer Experience: IoT allows banks to offer personalized services and real-time insights to customers.

- Operational Efficiency: IoT devices help streamline processes, monitor assets, and optimize financial operations.

- Improved Security: IoT contributes to better fraud detection and secure transactions through real-time monitoring and alerts.

As an advanced technology, the Internet of Things (IoT) is one of the most enticing tech concepts around the world. This next-gen technology enables networks of connected devices (e.g., sensors, cameras, smart gadgets) that simplify tasks such as real-time data collection and transfer it to the cloud for processing and analysis.

And react to events in real-time to integrate automation in the sectors like banking finance, supply chain, and more. Using IoT development services, BFSI companies are achieving great agility and efficiency in operations, security in the transaction, and enhanced customer experience.

You must be wondering how IoT can disrupt the banking and finance space for a better future. Let’s learn more about the impact of IoT development on banking & finance services.

Table of Contents

Understanding IoT’s transformative role in fintech

The IoT for banking is merging as a game-changer in the fintech revolution. IoT is revolutionizing financial services through biometric ATMs and AI-powered payment terminals. It is integrating digital and physical realms, and it is transforming banking from the ground up. Guaranteeing real-time operations, decision-making, intelligent security, and customized experiences.

What Is IoT in fintech?

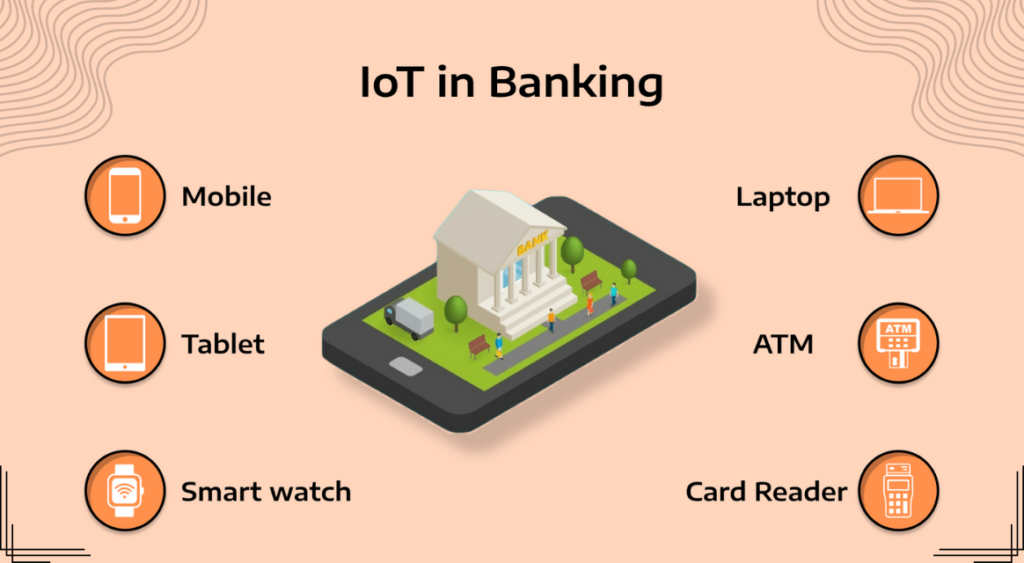

IoT in fintech refers to the interconnected devices that gather, send, and analyze financial data. These devices include smartwatches, payment terminals, biometric ATMs, and smart sensors.

These gadgets do more than just automated tasks. Traditional financial services are faster, safer, and more customer-focused in context-aware solutions. With the use of sensors, APIs, AI, and the cloud, for features like touchless banking and intelligent consumer engagement.

A look at the statistics around the globe

- IoT in Banking and Financial Services Market size was valued at USD 2,203 million in 2025 and will reach USD 37080.19 million by 2032, at a CAGR of 42.32%.

- North America leads the market with a 40% share, followed by Europe at 27%, while Asia-Pacific is growing the fastest due to rising digital adoption.

- Cloud-based IoT deployments and partnerships between banks and tech companies are accelerating innovation and expanding service reach.

- According to Fortune Business Insights, the global IoT market size in BFSI is estimated to reach US$116.27 billion by 2026, with a 26.5% CAGR between its forecasting periods.

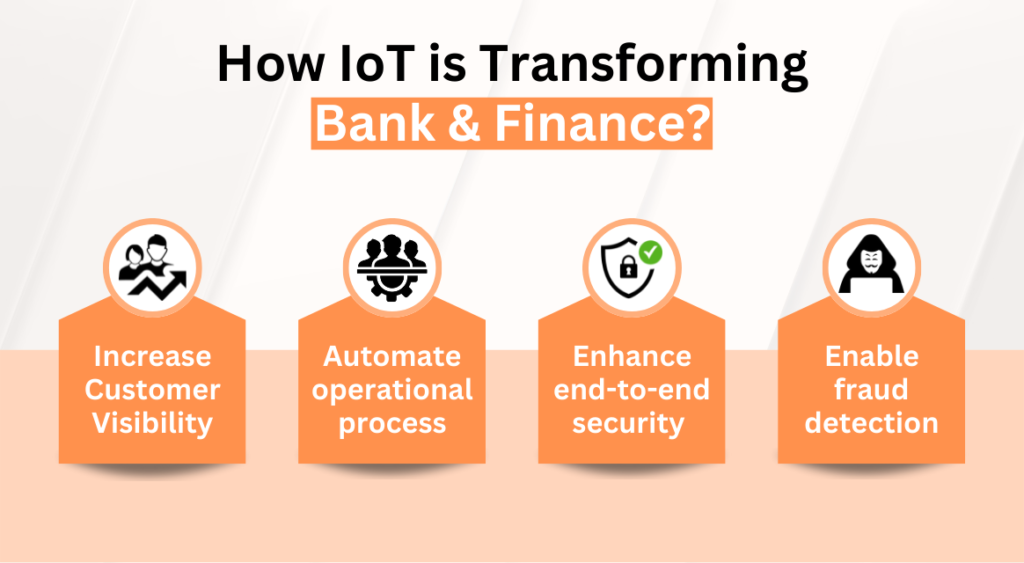

How IoT is Transforming Bank & Finance

-

Increased Customer Visibility and Personalization:

IoT solutions collect data from regular payment locations, consumer preferences, driving behavior, and many other sources that give BFSI businesses a better understanding of their clients’ needs.

With these detailed and updated customer profiles, they can personalize interactions with customers. It includes offering targeted services based on risks or needs identified through this analysis process or providing relevant financial assistance if needed.

-

Automation of Processes

IoT-powered systems can automate many tasks which would otherwise require human input; from processing request queues, opening bank accounts, and disabling credit cards. Overall, IoT-powered systems minimize the risk of human error. Such process automation is transforming not only transforming the BFSI industry. Other sectors like manufacturing are undergoing major IoT-driven shifts.

Interested in IoT Solutions for Banking & Finance?

Explore how IoT can enhance security, streamline operations, and provide innovative services in the banking and finance sector.

-

Enhanced Security

Connecting, remote controlling CCTV cameras, smart alarm systems, and other monitoring technologies. It ensures 24/7 security of private and company property as well as equipment: sending alerts in case of malicious activity.

Wearable devices are helpful to enforce customer authentication when they make purchases through mobile applications. All thanks to the enhanced safety measures that IoT provides.

-

Fraud Detection

Malicious activities and fraud are the most common issues banking and finance organizations are facing these days. AI-powered solutions with next-gen analytics capabilities can help to address and recognize frequent and most common attacks by analyzing user data.

Moreover, AI Development can tackle suspicious activities and alert users and organizations to avoid them. Besides, temporarily disabling features will terminate suspicious activities immediately to halt fraudulent activity.

-

One-touch Payments

IoT solutions and devices embedded in banking infrastructure/wearable allow users to make payments effortlessly without using debit/credit cards. Moreover, NFC-powered devices can enable contactless payments to ease online transactions.

The mentioned perks are enticing banking and finance organizations to implement the internet of things. If you are wondering how we can implement IoT in banking institutions with the help of IoT application development company, here are some major examples of it.

Evolution of IoT for Banking

Since the introduction of automated teller machines, the banking sector has advanced significantly. The idea of the Internet of Things (IoT) in banking was born out of the rapid improvements in technology that have transformed the way bank’s functions. The IoT has created new opportunities for better user experiences and increased operational effectiveness.

How do IoT devices connect and exchange financial data?

Automation and integration are key components of the IoT for banking. These gadgets have intelligent sensors that collect environmental data. After gathering data, it is sent via safe cloud networks using APIs. AI or ML algorithms then examine the data to find trends, evaluate risk, or initiate actions. Such as a smart ATM, alert the team, and flag a customer’s account for inspection.

Role of AI, ML, and Blockchain in IoT-powered fintech

IoT gathers data, but ML and AI are what conclude. These algorithms examine vast amounts of data from networked devices to:

- Forecast consumer behavior and provide appropriate financial products.

- Real-time fraud detection by spotting odd trends

- Simplify loan approvals by using intelligent credit scoring.

Blockchain guarantees security, transparency, and immutability of data processing. IoT, AI, and blockchain work together to produce a reliable finance environment.

How is business impacted by IoT in financial services?

The financial services industry has embraced IoT’s potential to provide clients with easy, individualized services. Transactions are now smooth and safe thanks to IoT gadgets like mobile payment systems and wearables. Financial institutions are using IoT to provide customized financial solutions by gaining real-time information about client behavior and preferences.

How IoT is showing its Impact on Banking Sectors?

IoT is having a big influence on the banking industry. Financial institutions can enhance decision-making, minimize mistakes, and automate operations by incorporating IoT devices and sensors into their different processes. IoT-based Retail Solutions, for instance, can gather and share information on consumer preferences and market trends, which helps financial institutions make wise investment choices.

IoT applications in the changing banking landscape

IoT will be crucial in changing the banking industry in 2025. Imagine entering a sophisticated bank branch where individualized service is provided by IoT gadgets that effortlessly connect.

- Facial recognition technology recognizes customers as soon as they walk in and notifies the appropriate banking professional.

- By integrating IoT, the client experience is streamlined, and labor-intensive manual identification procedures are removed.

Furthermore, the behavior and trends of customers can be continually monitored by IoT devices integrated into financial systems. Real-time analysis of this data makes it possible to identify any suspicious transactions or fraudulent activity. For example, the system can identify a customer’s credit card used as a suspect if it is being used concurrently at another place and notify the bank to take appropriate action. Banks can proactively safeguard the financial security of their clients with the use of IoT.

IoT’s use in finance

IoT is going to completely change the way financial institutions function in the field of finance. Businesses can automate several financial operations with the use of IoT devices and sensors, increasing productivity and accuracy. IoT, for example, can make it easier for asset monitoring systems and market sources to automatically gather data. Financial advisers can provide their customers with the most recent advice and suggestions by using this data to create real-time reports.

IoT can also be used for risk management and monitoring. IoT-enabled sensors can continuously track changes in the market and provide financial institutions with real-time information. Smart city solutions can provide effective growth to institutions so that they can make proactive adjustments to investment portfolios based on these data, guaranteeing that customers’ financial objectives are fulfilled.

IoT Integration in Banking

To effectively incorporate IoT into banking, financial organizations must set up a dependable and safe infrastructure. This entails putting in place reliable IoT devices, effective data-gathering techniques, and security and privacy measures for data. Additionally, banks need to teach staff members how to efficiently use IoT-enabled technology to improve client experiences and streamline operational procedures.

Moreover, industry stakeholders’ cooperation is essential to the smooth integration of IoT in banking. Financial institutions must collaborate with technology firms and regulatory agencies to develop industry-wide guidelines and procedures for the deployment of IoT. By working together, we can promote innovation and make sure that everyone benefits from IoT in banking.

IoT Integration in Finance

Like banking, the integration of IoT in finance requires industry cooperation and a solid technology base. Financial services organizations need to put in place safe data collecting and analysis procedures as well as a strong IoT infrastructure. They also have to make sure that regulations are followed to protect the security and privacy of data.

Financial institutions should also actively look at forming alliances with IT firms to benefit from their experience implementing IoT. Smart warehouse solutions can provide effective benefits to finance firms that can fully use IoT to provide their customers with exceptional financial services by collaborating with IoT specialists to optimize their systems.

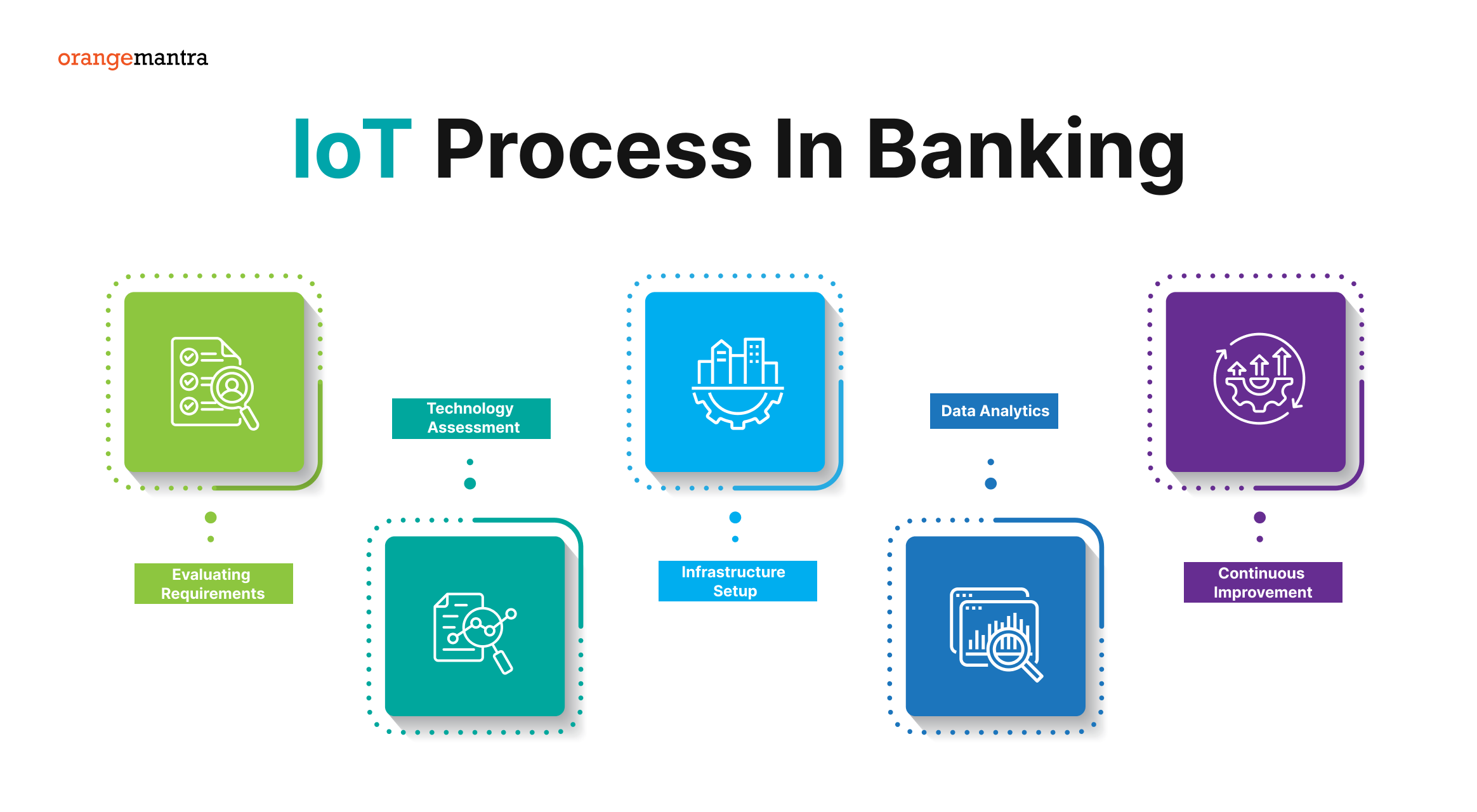

The Five-Step IoT Process in Banking

Using IoT for banking requires a methodical approach. The following five steps will help financial institutions use IoT technologies:

-

Evaluating Requirements:

Determine certain areas of the banking process that IoT can significantly enhance. This might include improving security protocols, expediting client onboarding, or increasing operational effectiveness.

-

Technology Assessment:

Examine current IoT technologies and choose those that best meet your requirements. Take into account elements like cost-effectiveness, scalability, compatibility, and dependability.

-

Infrastructure Setup:

Construct the infrastructure required to enable the deployment of IoT. This entails putting in place backend systems, networking devices, and sensors that can gather, process, and use data created by the Internet of Things.

-

Data Analytics

Develop your data analytics skills to extract useful information from the IoT data that has been gathered. Invest in powerful analytics software and algorithms that can handle massive streaming data volumes to extract insightful business information.

-

Continuous Improvement:

Keep an eye on and assess your IoT deployment strategy’s efficacy regularly. With the help of smart factory solutions, one can take consumer input and new market trends into consideration as you modify and improves your IoT solutions.

The Five-Step IoT Process in Finance

Financial firms can use IoT in the finance sector effectively by following a similar five-step process:

-

Finding Opportunities:

Determine which aspects of finance the Internet of Things can significantly advance. This might include improving client interaction, streamlining risk management procedures, or refining investment plans.

-

Technology Selection:

Assess the many IoT technologies available and choose those that correspond with the possibilities you have identified. IoT provides effective benefits to smart hospital technology it considers elements like scalability, security, dependability, and compatibility with current financial systems.

-

Infrastructure Development:

To support financial processes, provide a strong Internet of Things infrastructure. To do this, secure data-gathering methods must be established, IoT devices and sensors must be deployed, and smooth interaction with current financial processes must be guaranteed.

-

Insights

Gaining useful insights from the gathered IoT data requires the development of sophisticated data analytics skills. With the help of IoT smart home automation makes data-driven choices and enhances financial results by putting predictive analytics models and machine learning algorithms to use.

-

Continuous Monitoring and Optimization:

Keep an eye on and improve your financial IoT systems constantly. Take regular stock of your IoT deployment’s performance and effects and change as needed to maintain maximum efficacy and efficiency.

To sum up, IoT will completely transform the financial and banking sectors. Financial institutions can boost innovation, increase operational efficiency, and improve client experiences by incorporating IoT devices. But for IoT deployment to be effective, meticulous preparation, teamwork, and a dedication to security and privacy are needed. Banks and financial services companies can take a revolutionary step towards a smarter future by using a methodical strategy and concentrating on utilizing IoT’s potential. Let’s greet the Internet of Things (IoT) age in banking and finance with excitement and look forward to the opportunities it presents.

How You Can Implement IoT Solutions in Banking & Finance

-

Smart Branch Ecosystem

IoT-enabled smart workspaces are one of the most sought-after trends for businesses. It allows you to have a customized customer experience while visiting the branch by queue monitoring, reducing waiting time, or directing them to another counter.

Sharing real-time customer & workspace data allows branches to improve workflow and reduces staff involvement. Virgin Money’s Studio B in London is one prominent example of this. It allows customers to use voice assistants like Alexa.

It also leverages voice recognition to learn how customers interact with the space.

-

Smart ATMs

Banks can monitor customers’ activity through IoT-connected ATMs using data found on environmental parameters including room temperature, light, and motion. These connected ATMs are self-aware machines that adjust to demand while reducing energy costs by lowering air conditioning.

And electric lights when the location is clear of foot traffic or those waiting in line for an ATM transaction. These machines can safeguard against security breaches such as skimming devices or fraud due to malfunctioning card readers or a lack of money thanks to constant monitoring from its internal sensors.

-

Trade Finance

The banks involved in trade financing can utilize IoT solutions to radically automate operations and fraud detection. Banks are utilizing the power of IoT for better decision-making by implementing state-of-the-art systems that can provide insight into every aspect of a trade’s life cycle.

They use this information to make decisions based on real-time data rather than performed assumptions. This allows them to increase efficiency and find new methods for scaling up their finances while simultaneously increasing transparency among company inventories, including such details as what types of assets each company has been storing at which location.

-

Insurance

Insurance is one of the major play fields for IoT devices in the finance industry. IoT-enabled devices enable device monitoring to learn about the state of an insured object. Also, such a solution can also alter the insurer about re insuring any abnormalities. `

-

Accounting and Audit

In an Internet of Things (IoT)-enabled world, the clients’ payment system communicates automatically with the CPAs’ software which means no need for tedious data entry or manual handling. Accountants will be able to track financial information in real-time and get accurate insights into a company’s operation.

This can help them provide better services than ever before. Another great way IoT improves both accounting and audit is by making it transparent: CPAs can monitor transactions without error or fraud occurring; all because they are controlling it remotely on their computer!

What’s driving IoT adoption in fintech?

Here are the major upcoming IoT for banking trends to drive in fintech.

Rise of contactless payments

As NFC-enabled cards, tap-to-pay systems, and mobile wallets gain popularity. It is possible with IoT-enabled terminals in public settings where speed and cleanliness are crucial. You can hire IoT developers for any extended help.

Real-time financial data

IoT sensors and gadgets are used by banks to watch consumer activity. So, keep an eye on asset transfers and identify odd spending trends. Predictive analytics, fraud alerts, and individualized financial services are possible with real-time visibility.

Escalating security concerns

IoT-based biometric authentication, facial recognition, and behavioral analytics. It offers strong security layers above passwords and PINs as cyber threats become complex.

Hyper-personalized banking

Clients desire to be “known” by their bank. IoT for banking provides insights into requirements, preferences, and behaviors. As, it enables services like location-based discounts, AI-powered budgeting, and fast loan offers.

Real-world use cases to reinvent banking

Here are the common use cases of the banking revolution with IoT.

Smart ATMs

ATMs IoT sensors can automatically detect hardware problems and track cash levels. Biometric verification, like fingerprint or retinal scanning, improves security. As soon as a customer enters, smart branches use these insights to provide personalized services.

Asset Monitoring

Many high-value assets, automobiles, machinery, and construction equipment are financed by banks. IoT for banking can monitor usage, track position in real-time, and evaluate wear and tear. This helps in recovery as well as loan disbursements.

Risk Assessment

IoT devices provide information on consumer behavior, economic activity, weather, and market trends. Better credit risk modeling, insurance pricing, and investment choices are supported by real-time intelligence.

Customer Engagement

Mobile apps and smartwatches connected to banking platforms monitor how users spend their money. It makes it possible for banks to offer AI-based savings, spending notifications, and tailored advice.

Security and Surveillance

IoT-enabled surveillance systems keep an eye on data centers, bank branches, and ATMs. These technologies identify and react to possible security breaches instantly. When paired with MFA methods, like facial recognition and behavioral biometrics.

Challenges faced while integrating IoT in fintech

Here are the loopholes faced by IoT for banking integration.

- Hackers have additional entry points when there are more linked gadgets.

- It takes enormous computer power to store real-time data from thousands of devices.

- It’s still difficult to guarantee permission, privacy, and legal data use.

- It can be costly and time-consuming to combine IoT systems with legacy financial infrastructure.

- To deploy IoT securely, financial institutions will need to implement compliance-by-design frameworks.

The potential future of IoT for banking

Here is how IoT for finance will shape the future.

5G Faster Connectivity

Data transfer latency drastically decreases as 5G networks become more widely available. Faster communication between IoT devices will allow for real-time financial choices. Or get IoT development services for more assistance.

AI-IoT convergence

The IoT inputs and AI models trained on past financial data will combine to create clever fintech apps. As it ranges from real-time fraud detection to user interfaces that adapt to your financial habits.

Self-healing systems

Self-healing systems, where servers, ATMs, or branches can anticipate faults and auto correct. It will be made possible by IoT for finance infrastructure.

Wrapping Up

With emerging technologies such as the Internet of Things, banking and financial institutions can now offer greater levels of customer service. With this new system comes a variety of perks:

From 360-degree views of your clients’ spending habits to advanced insurance programs, as well as providing an improved level of efficiency. And besides, convenience for your customers reaches the next level with IoT.

For all these reasons – if you want to take advantage of this technology, connect with an IoT application development company now.

FAQs

1. What IoT-related banking difficulties exist?

- Disintermediation and embedded finance

- The risk of fraud and cyber security.

- Change the channel.

- Compliance with the data.

- Inclusion of finances.

2. What important uses does the IOT have for finance?

Bank branches, ATMs, and data centers are continuously monitored by banking and financial services with the aid of IoT sensors and smart devices. Through biometric authentication, facial recognition, and behavioral analytics, the Internet of Things integration with multi-factor authentication (MFA) systems further enhances security.

3. What applications does IoT have in banking?

Deep insights on consumer behavior, including branch visits, ATM usage trends, and digital interactions, are made possible by IoT. Banks can improve customer happiness by customizing offers and promotions with the use of this data.

4. In what ways does technology play a role in banking?

AI in banking drives loan processing automation, credit scoring, fraud detection, chatbot customer service, and predictive analytics for customer retention.

5. What technologies will be used in banking in the future?

Highly secure identity and authentication techniques will be required by future banks. Blockchain technology provides a means of conducting digital transactions and securely storing identities. Additionally, biometric technologies like fingerprint scanners and facial recognition will become more prevalent.